The Importance Of Bankruptcy Education: Insights From Tulsa Bankruptcy Attorneys

The Importance Of Bankruptcy Education: Insights From Tulsa Bankruptcy Attorneys

Blog Article

A Guide To Medical Debt Bankruptcy By Tulsa Bankruptcy Attorneys

Table of ContentsBankruptcy Attorney Tulsa: The Impact Of Repossession On Your Bankruptcy CaseTulsa Bankruptcy Lawyer: Understanding The Means Test And Bankruptcy EligibilityThe Role Of Tulsa Bankruptcy Attorneys In Personal BankruptcyTulsa, Ok Bankruptcy Attorney: How Bankruptcy Can Wipe Out Credit Card Debt

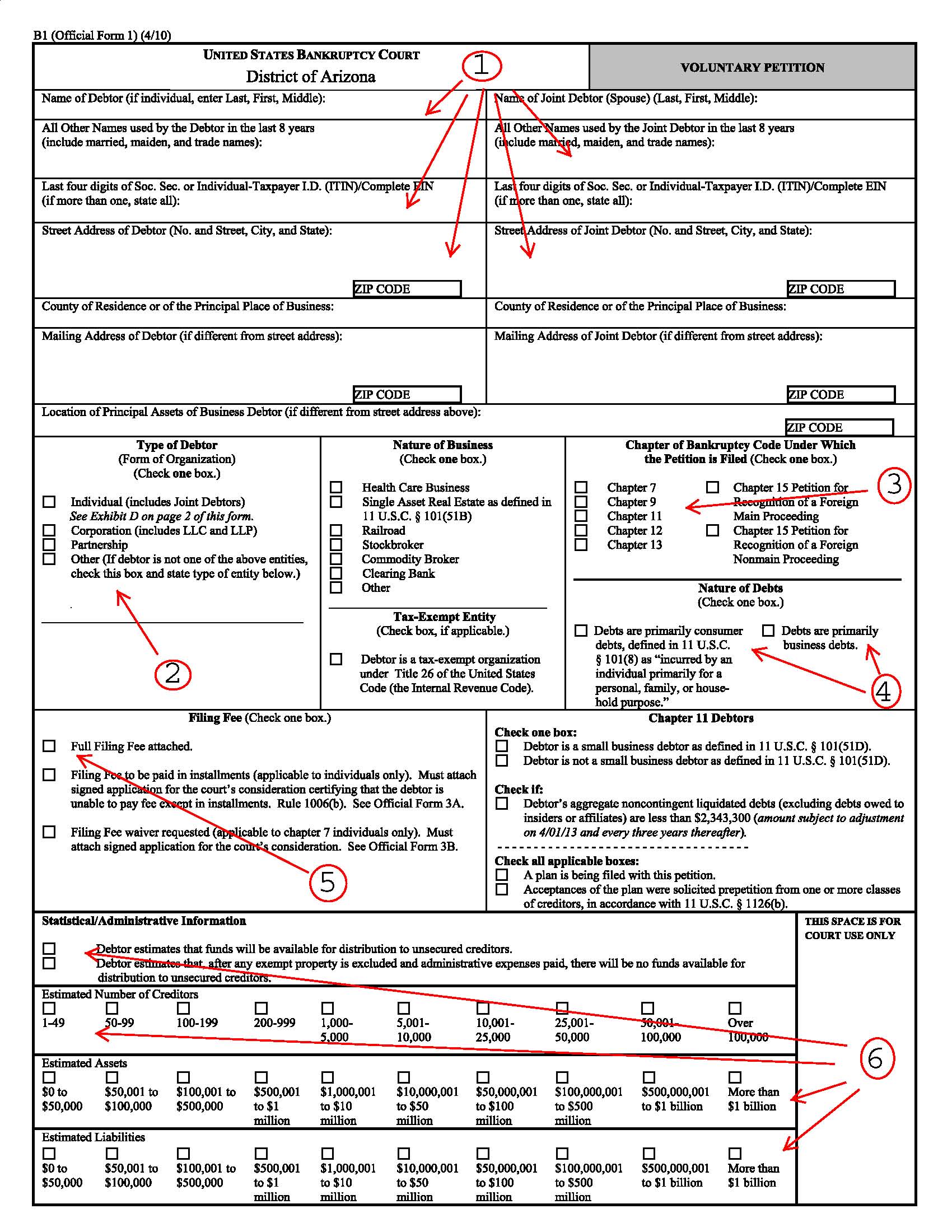

It can harm your credit report for anywhere from 7-10 years and also be a barrier toward obtaining safety and security clearances. However, if you can't settle your problems in less than 5 years, insolvency is a viable alternative. Legal representative costs for insolvency differ depending upon which create you pick, how complex your situation is and also where you are geographically. Tulsa OK bankruptcy attorney.Various other insolvency prices include a declaring fee ($338 for Phase 7; $313 for Chapter 13); as well as charges for credit history counseling as well as monetary management programs, which both price from $10 to $100.

You don't constantly require an attorney when submitting specific personal bankruptcy by yourself or "pro se," the term for representing on your own. If the situation is easy sufficient, you can apply for insolvency without help. Yet most individuals benefit from depiction. This post explains: when Phase 7 is too complicated to manage yourself why working with a Chapter 13 attorney is always crucial, and if you represent on your own, exactly how a personal bankruptcy petition preparer can help.

, the order eliminating debt. Strategy on filling out comprehensive documentation, collecting financial documents, looking into bankruptcy as well as exemption legislations, as well as following regional regulations and procedures.

Tulsa Bankruptcy Lawyer: Understanding The Means Test And Bankruptcy Eligibility

Below are 2 circumstances that constantly ask for representation. If you have a small company or have revenue above the mean degree of your state, a considerable quantity of possessions, top priority debts, nondischargeable financial debts, or lenders that can make insurance claims versus you based upon fraud, you'll likely want a legal representative.

You might desire to file Chapter 13 to capture up on mortgage arrears so you can keep your house. Or you might intend to get rid of your bank loan, "pack down" or lower a vehicle loan, or repay a financial obligation that will not disappear in bankruptcy in time, such as back taxes or support financial obligations.

You might desire to file Chapter 13 to capture up on mortgage arrears so you can keep your house. Or you might intend to get rid of your bank loan, "pack down" or lower a vehicle loan, or repay a financial obligation that will not disappear in bankruptcy in time, such as back taxes or support financial obligations.In several cases, an insolvency legal representative can quickly determine concerns you may not detect. Some individuals documents for insolvency because they don't understand their options.

Tulsa, Ok Bankruptcy Attorney: How To Deal With Medical Debt In Bankruptcy

For many consumers, the sensible selections are Phase 7 and Phase 13 insolvency. Each type has specific benefits that address specific problems. If you desire to conserve your house from foreclosure, Chapter 13 might be your finest bet. Phase 7 could be the way to go if you have low earnings as well as no assets.

Right here are typical concerns personal bankruptcy attorneys can avoid. Insolvency is form-driven. Numerous self-represented insolvency debtors do not file all of the required YOURURL.com bankruptcy documents, and also their situation obtains rejected.

You do not shed everything in personal bankruptcy, but keeping property relies on recognizing exactly how property exemptions job. If you stand to shed useful residential or commercial property like your home, automobile, or various other residential or commercial property you appreciate, an attorney could be well worth the money. In Chapters 7 and 13, bankruptcy filers have to receive credit counseling from an accepted company before applying for personal bankruptcy and finish a monetary management training course on trial releases a discharge.

Not all insolvency instances proceed efficiently, and also various other, much more challenging concerns can emerge. Many self-represented filers: don't comprehend the value of movements as well as foe activities can't adequately defend against an activity looking for to reject discharge, as well as have a difficult time conforming with complex personal bankruptcy treatments.

Bankruptcy Lawyer Tulsa: Understanding The Rights Of Creditors In Bankruptcy

Or something else could emerge. The bottom line is that a lawyer is vital when you discover on your own on the obtaining end of an activity or legal action. If you decide to apply for insolvency on your own, learn what services are readily available in your area for pro se filers.

Others can link you with lawful aid organizations that do the very same. Several courts and their sites have info for customers declaring insolvency, from brochures describing affordable or free services visit homepage to in-depth info regarding personal bankruptcy. Obtaining an excellent self-help publication is also an outstanding idea. Try to find a bankruptcy publication that highlights circumstances needing an attorney.

You must accurately fill in lots of types, research the legislation, as well as go to hearings. If you understand bankruptcy law however would such as help finishing the forms (the average personal bankruptcy petition is about 50 pages long), you could think about hiring a personal bankruptcy request preparer. A bankruptcy petition preparer is any kind of person or organization, besides a legal representative or someone that works for a legal representative, that bills a fee to prepare bankruptcy files.

Due to the fact that bankruptcy application preparers are not lawyers, they can't offer lawful recommendations or represent you in bankruptcy court. Specifically, they can't: tell you which kind of bankruptcy to submit tell you not to provide certain debts tell you not to note specific possessions, or inform you what residential or commercial property to excluded.

Due to the fact that bankruptcy application preparers are not lawyers, they can't offer lawful recommendations or represent you in bankruptcy court. Specifically, they can't: tell you which kind of bankruptcy to submit tell you not to provide certain debts tell you not to note specific possessions, or inform you what residential or commercial property to excluded.Report this page